Company Overview

Goody’s Credit Card is an in-store credit card issued for the dedicated customers of the Goody’s Stores. The credit card is also known as the Stage Credit Card. Goody’s is a clothing store based in the United States. It is headquartered in Houston, Texas, United States. It specializes in offering accessories, cosmetics, housewares, footwear and trending apparels. Goody’s operated 500 stores in the United States including provinces- Tennessee, Knoxville, Lowa, Kanas, Louisiana, Maryland, North Carolina, Midwest and Kentucky.

Overview of the Goody’s Credit Card

As the name suggests “Goody’s” the credit card is home to a wide range of rewards when used at the Goody’s Clothing Inc. or the Stage Stores. The credit card is a generous one, as it requires a fair score to get approved yet offers a lot of rewards when used at the Stage Stores. One can receive a welcome coupon on being used for the first time, birth day offers and more. Read on for a detailed review of the Good’s Credit Card.

Goody’s Credit Card Review

Pros

The Goody’s Credit Card is good for ones who are loyal shoppers of the store- If you usually visit the Goody’s clothing store then the credit card is a great one for you. It comes loaded with an introductory bonus and cash backs.

If you are looking for pay back rewards– Goody’s Credit Card lets you earn a $5 payback reward for every 100 points.

If your Credit Score is not Too High- Goody’s Credit Card requires an average credit score for approval. Thus, even if your credit score is fair you can get the approval and enjoy seamless shopping at the Stage and Goody’s stores.

Cons

If you are searching for a Regular Rewards Card- As discussed earlier, the Goody’s Credit Card is made to use at the Goody’s and Stage stores. Hence, it has major rewards targeted at in-store purchases. In case you are wishing to have a typical rewards card then you might look for other credit cards that are showered with rewards.

Customers who seldom visit the Goody’s Stores- The credit card is majorly for dedicated customers of the Goody’s clothing brand. If you do not visit the store often there is no use getting the card inside your wallet.

Benefits of the Goody’s Credit Card

- The Goody’s Credit Card provides a $5 payback for 100 points rewards earned with any type of payment.

- Spending $1 you can earn 1 point which can be later redeemed for purchases.

- $1 spending with the in-store credit card earns 2 points.

- Earn exclusive card holder rewards plus savings.

- There card is fuelled with a broad array of Christmas and Birthday rewards. Birthday rewards include the following- Preferred = $10, Platinum = $20

Goody’s Credit Card Rate and Fee

- The regular APR rate of the Goody’s Credit Card is 28.99%.

- Purchase Intro APR is not offered.

- Balance transfers are not allowed.

- The annual fee is $0.

- Max late fee for the credit card is $38.

- Grace period is 25 days.

- You do not have to pay any amount for foreign transactions.

- There is no fee for cash advances.

Credit Requirements

- For approval you need to have a fair credit.

- Have a valid SSN.

- Be a resident of the United States.

How to apply for a Goody’s Credit Card

Step 1– In order to get the credit card inside your wallet you must visit the Comenity Bank’s application page. https://d.comenity.net/stage/pub/apply/ApplyIntro.xhtml

Step 2– The applicant must glance at the cardholder benefits, view disclosures and enter the following personal information:

- Full Name

- SSN

- Date of Birth

- Annual Income

Step 3– Scroll down to the contact information section and enter the following data:

- Zip Code

- Street Address

- City

- State

- Email Address

- Phone Number

Step 4– Check the ‘Yes’ option if you wish to add an authorized user and click ‘Continue’.

How to Check Application Status

For checking your Goody’s Credit Card application status one must call on 1-866-234-2038. Enter SSN or application ref number to know your status.

Activate a Goody’s Credit Card

Step 1– For credit card activation one must go to the registration page. https://d.comenity.net/goodysonline/pub/register/Register.xhtml

Step 2– To activate your credit card for usage you should enter the following details:

- Credit Card Account Number

- Zip Code/Postal Code

- Identification Code

- Last 4 Digits of SSN

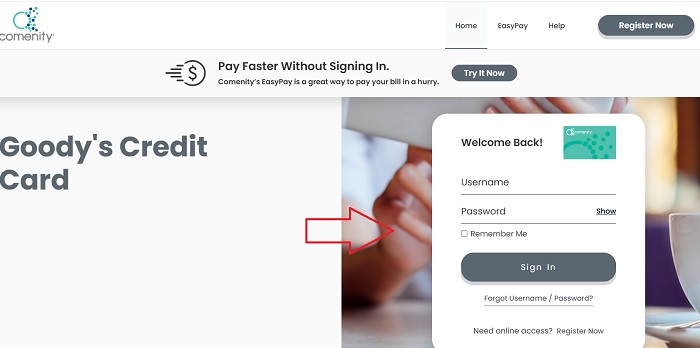

How to Log into Goody’s Credit Card

Step 1– To log into your account you need to visit the login page. https://d.comenity.net/goodysonline/pub/signin/SignIn.xhtml

Steps 2- For signing in enter user name, password and click ‘Sign In’. The system will direct you to the account management console from where one can pay bills online, view statements and more.

Forgot User ID or Password

Step 1– If any user has lost login credentials, then they must go to the sign in page and select the link that reads “Forgot your user name or password?”

Step 2– Next you will be asked to provide account number or username, identification information and last 4 digits of SSN.

How to Enroll

Step 1– New customers who wish to set up online access can navigate to the registration screen. https://d.comenity.net/goodysonline/pub/register/Register.xhtml

Step 2– Enter the following data to get started:

- Credit Card Account Number

- Zip Code/Postal Code

- Identification Code

- Last 4 Digits of SSN

Step 3– Now you can create an account by agreeing to the terms and conditions. Set a username and password for logging in and you are ready to go.

Goody’s Credit Card Payment

Pay via Mail

Cardholders can send their payment check to the address listed below:

Goody’s Credit Card

P.O. Box 659465, San Antonio, TX 78265-9465.

Pay In-Store

The credit card offers in-store payment facilities to the customers. Thus you can visit any of the Goody’s Stores to pay credit card bills.

Pay Online

In order to make an online payment the customer needs to log into their credit card account.

Enter payment information, select a date to pay and confirm.

The Bottom Line

The Goody’s Credit Card is a generous deal for the regular shoppers of the store. If you are looking forward to apply then you must go through the review and benefits of the credit card above. However, existing card holders can manage account using any internet connected device anytime and anywhere.