In this article you can find a complete Ally Invest Review 2023. We have provided the pros and cons of Ally Invest, Ally Invest Login, Frequently Asked Questions and more.

Ally Invest is an investment trading platform that features managed and self-directed investments. The investment company is a subsidiary of the Ally Financial which is a bank holding company based in the United States. Ally Invest is a close rival to most of the investment firms and online brokers in the nation. To the astonishment of the users the online trading platform offers sublime features such as automated portfolio management that are not available at any other trading portal.

On the other hand the commission is much cheaper that other platform out there. Only a handful of online brokers can compete with the low commissions charged by the Ally Invest. However, before beginning to invest with the Ally Invest you must be looking for a detailed review of the online trading and investment services provider. Read below for an insight into Ally Invest Review and How to Log into Ally Invest.

Ally Invest Review 2023

Company Overview

- Commissions charged by the Ally Invest is 4.95

- Promotion includes $50-$3500 in cash bonus topped with free trades with a qualifying deposit.

- Login Helps rating for the Ally Invest is 4.5

Why should you Choose Ally Invest

- Forex Traders

- Active Traders

- Options Traders

Ally Invest Overall Review

While an overall review of the Ally Invest we found that the company has a low commission base. It among the best picks from the online trading and investment industry. Active investors would surely love the Ally Invest as it makes over 30 or more trades per quarter or holding a balance of $100,000 or even more.

Keeping in mind the discounting ways, Ally added commissions’ free exchange traded funds to its investment catalogue. The low margin rates and commission charged by Ally Invest is hard to find in any other online trading portal.

Minimum account balance of $0 is pretty impressive as there are no hurdles to get started with online trading for beginners. Ones who are looking for low minimum account balance would find Ally Invest a cosy place.

| Overall Customer Ratings | 4.5 |

| Stock Trading Costs | $4.95 volume discounts are available |

| Minimum Account Balance | $0 |

| Options Trades | There is a volume discount. $4.95 + $0.65 is charged per contract |

| Annual Transfer Fee | $0 is charged for in-activity, $50 for full outgoing transfers |

| Commissions Fee ETFs | Over 100 commission fee ETFs |

| Tradable Securities | Forex

ETFs Mutual Funds Bonds Stocks Options |

| No Transaction Fee Mutual Funds | $9.95 per trade |

| Mobile App | Access to account data and trading |

| Promotions | $50-$3,500 in cash bonus and free trades |

| Customer Support | Online chat support and phone support service available |

| Data and Research | Free |

How to Log into Ally Invest

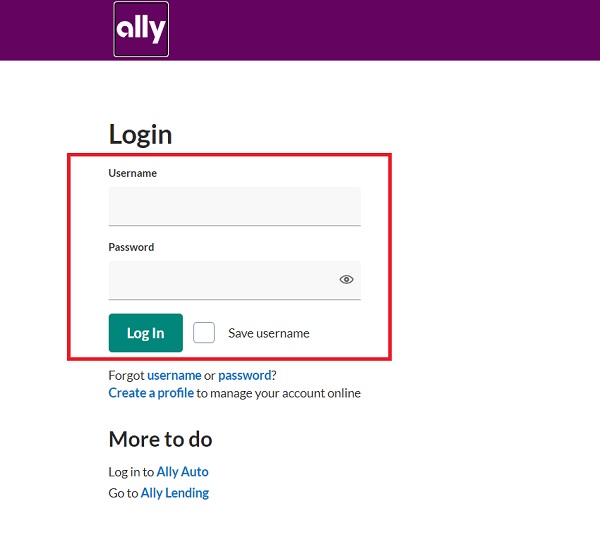

Customers of the Ally Bank and Ally Invest can log into their account at the website of the Investment Company. Once logged in the services are easy accessible on a smartphone, computer or laptop. You will be required to remember login credentials and stay connected to the internet.

Step 1– For logging into Ally Invest, go to the login page [secure.ally.com].

Step 2– Once the website opens you will find the login widget at the center.

Step 3– Enter the username and password in the blank spaces and click “Login”.

Ally Invest Frequently Asked Questions

Is Ally Invest Safe to Invest?

Yes it is totally safe to invest in Ally Invest as the bank is FDIC Insured and is a federal banking body. Banking products up to $250,000 at Ally Invest are insured by the federal government.

What are the cons of Ally Invest?

As every coin as two sides, Ally Invest also has some downsides. When you look at the cons of you will find that it has limited stock/ETF trading options. The account management portal features an old interface which is not friendly for the users.

Where can I get the Ally Invest app?

You can download the Ally Invest app from the Google Play Store or Apple App Store. The application can be installed on your mobile device and you can sign in when prompted. Here is the download URL of the Ally Invest app.

How can I set up Ally Auto payment

If you have finances from the Ally Auto then you can make a payment by signing into your account online. The user can also set up auto payments to allow the bank automatically deduct the amount from your bank account.